Mannes Technology: FinTech for Banks, Brokers, and Investors

Mannes Technology offers portfolio and risk management solutions for the front and middle office of brokers and banks.

Our 20 years of experience in building real-time trading systems has yielded a set of reusable software components that enable us to create reliable, scalable, flexible, and highly efficient solutions for trading, finance, and investing.

Our systems are available on-premises or in the cloud.

Risk Engine

Pre-trade risk management for real-time, multi-asset-class trading systems, including leverage and derivatives.

Margin Engine

Calculate magin requirements in real-time for CME, EUREX, EuroNext, MEFF, ICE, and most other derivatives exchanges.

OMS/EMS

Order and execution management system: off-hours trading, linked orders, synthetic order types, and automated strategies.

Real-time risk management

Risk Engine

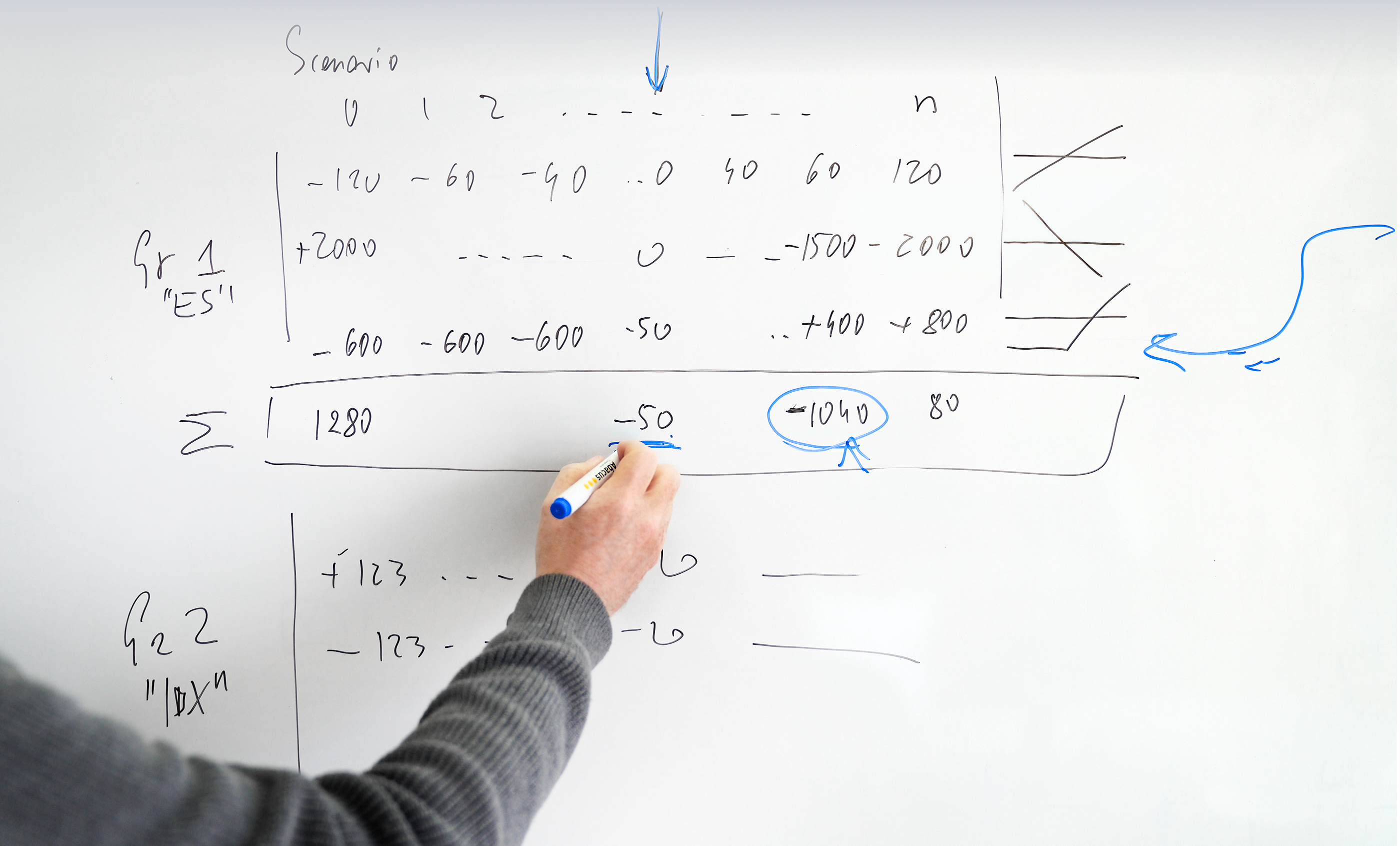

Pre-trade risk management allows a broker or bank to enforce trading limits and limit losses before they happen. Our risk engine is capable of computing the worst-case impact of orders - for any instrument class including futures and options. User-defined buying power rules let end-users apply additional leverage.

-

Multi-Asset-Class

- Supports equity, futures, options, forex, and fixed income. Portfolios can hold assets and cash in any currency.

-

Leverage

- Margin trading - including extra intraday leverage - is supported for all asset classes. Bespoke buying power rules allow offering and controlling leveraged trading.

-

Risk Measures

- Calculates valuations, PnLs, collateral, leverage, margin, and VaR. Worst-case scenario for derivative orders takes margin requirements into account.

Calculate margin requirements in real-time

Margin Engine

Our universal margin engine can compute margin requirements for listed futures and options for multiple exchanges and methodologies, covering all of the world's most important derivative exchanges. We replicated multiple margining methodologies to calculate portfolio-based margin for multiple exchanges and currencies.

-

Multi-Product, Multi-Exchange

- Covers futures and options listed on CME, EUREX, ICE, EuroNext, CBOE, MEFF, IDEM, NYMEX, COMEX, and many others using SPAN

-

Multiple Algorithms

- Supports the SPAN, Prisma, CBOE, and MEFFCOM margining methodologies.

-

Fast

- We have replicated margining algorithms so we can calculate margin requirements in milliseconds or less.

-

Worst-Case Order Impact

- Can calculate worst-case impact of a new order, perform what-if analysis.

-

Margin Insight and Reports

- Produces detailed reports at every level from portfolio down to individual instruments

-

Zero Maintenance

- Margin parameters and market data collection is managed as part of the service, no need for daily downloads.

-

Cloud Ready

- Available as a secure, cloud-based, stand-alone service with an API.

Order/execution management system

OMS/EMS

The FinanceGear order and execution management system uses a detailed database that supports real-time, low-latency, cross-asset-class trading systems. The OMS/EMS supports synthetic order types such as OCOs/OTOs or trailing stops when the downstream broker doesn't support them, and can hold orders for later delivery when exchanges or routings are closed.

-

Scalable and Battle-Tested

- Built on our proven technology platform, the OMS can scale easily under load.

-

Synthetic Order Types

- Supports many order types: conditional orders, stop/stop limit, OCO (order cancels order), OTO (order triggers order), trailing stops, iceberg, etc.

-

Blotter

- The blotter tool lets you get an overview of all orders in the system and intervene when necessary.

Order routing via the FIX protocol

FIX/DMA

The FIX protocol is the de facto standard in broker-exchange connectivity. The vast majority of exchanges and brokers offer order routing through the FIX protocol. We offer a FIX engine that greatly simplifies connecting to brokers or exchanges. The FIX engine adapts to FIX version and "dialects", making it easy to roll out new order routing connectivity. Using our engine, we have successfully implemented order routing with many exchanges and brokers.

-

Flexible

- Easily adapted to FIX versions and dialects, including non-standard implementations.

-

Fast

- Implemented in C++ for speed and control

-

Battle-tested

- Has been used to connect to Bloomberg, Reuters, Sungard, Altura, GL Trade, MEFF, Santander, Commerzbank, FXCM, 360T, and others...

Post-trade risk management

Risk Monitoring

The post-trade risk management system keeps tracking risk and PnL values for some or all portfolios. Should any position exceed established limits - cash levels, margin vs collateral, etc, alerts are generated. If leveraged customers enter into margin call, they are first given warnings, then the system begins automatically liquidating positions until portfolios are back within risk limits.

-

Margin Call

- Automatically detects situations that require a margin call. Alerts both operators and end users of critical situations.

-

Liquidation

- When necessary, automatically liquidates portfolios following custom procedures.

-

Scalable

- Can monitor any number of portfolios in real-time.

Our Clients: Banks, Asset Managers, and Integrators